The recent tariff announcements by the US on its top trading partners illustrate the increasing complexity of the global trade environment. This unpredictability of policies is urging businesses to reassess their supply chain strategies, with tariff volatility introducing potential cost increases and significant risks across supplier relationships, customer demand, and fulfillment logistics.

While some companies might be inclined to adopt a wait-and-see approach, supply chain leaders must act proactively to mitigate risks, build resilience strategies, and even find competitive advantages amid uncertainty.

As we explored in our latest webinar, the key to navigate tariff uncertainty lies in scenario planning, which enables companies to take proactive action and prepare for multiple potential outcomes, instead of reacting to new tariffs as they arise. A playbook of options for tariff volatility helps teams evaluate strategies that account for different levels of risk, across different time horizons and financial investments.

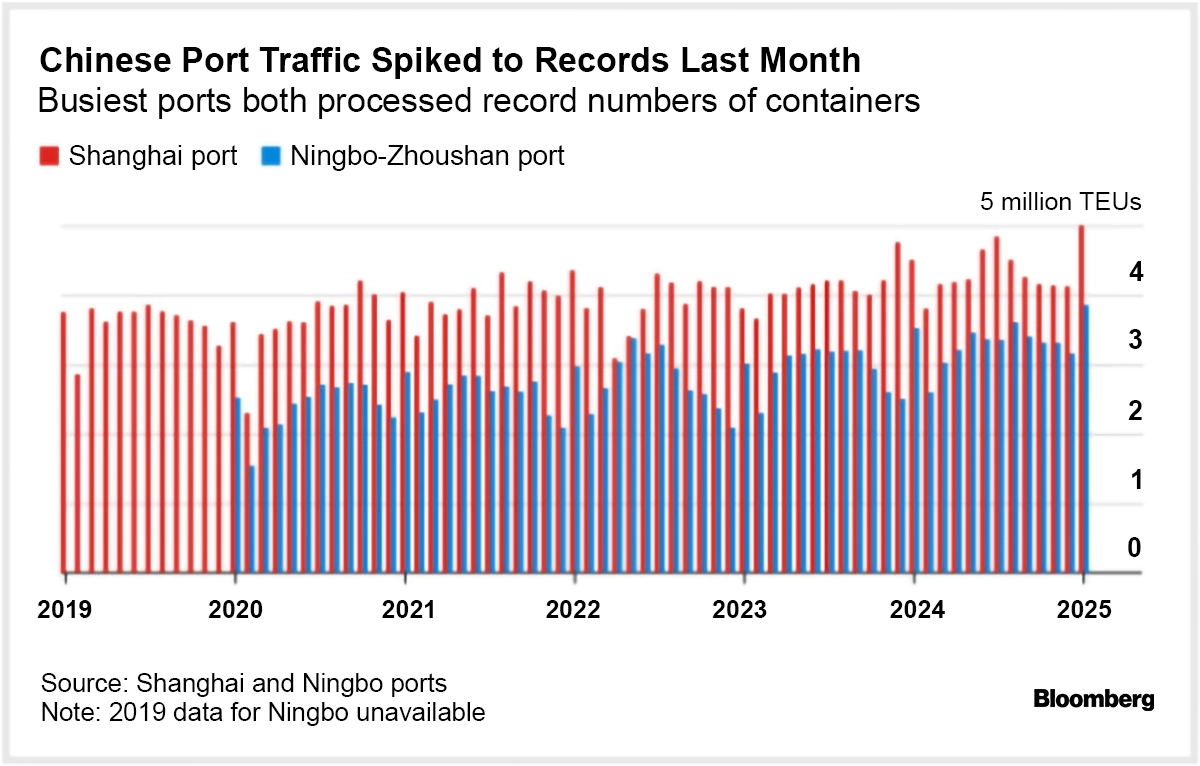

One immediate strategy is to stockpile inventory before tariffs take effect. This allows companies to avoid immediate cost hikes and to delay price adjustments. We see evidence of companies taking this approach as port traffic has hit new records in the last month (see Figure 1 below). But this approach comes with risks, including increased holding costs and cash flow constraints. As a short-term buffer and not a permanent solution, this action works best when combined with longer-term supplier diversification strategies.

Foreign Trade Zones (FTZs) provide another way to mitigate tariff impact. These are designated areas where imported goods can be stored, processed, or assembled without immediately incurring tariffs. Companies can defer tariffs until goods enter the domestic market, or use FTZs to manufacture products with lower tariff classifications. While FTZs provide temporary relief, they may not offer long-term stability as trade policies continue to evolve.

Two critical areas to address with scenario planning are supplier risk impact and demand and price elasticity considerations — both of which can shape an organization’s ability to absorb tariff-related costs, manage risks, and maintain profitability.

Scenario Planning for Supplier Risk Impact

Tariffs directly increase costs on imported goods, but their ripple effects go much deeper. Companies must analyze how these added costs impact supplier relationships, overall profitability, and supply chain efficiency. To effectively manage supplier risk, it’s important to model cost, alternative sourcing, and supply chain flexibility.

If tariffs significantly increase costs from one region, companies can explore alternative suppliers in non-tariffed or lower-tariffed countries. This might involve regional diversification to shift production to countries unaffected by tariffs, nearshoring, or domestic sourcing strategies.

However, supplier diversification requires careful cost-benefit analysis. While tariff-free sourcing may reduce direct costs, it might increase production expenses, supplier lead times, or quality risks. Businesses must assess trade-offs between tariff-related costs and broader supply chain factors like speed, reliability, and scalability.

To make informed decisions, it’s critical to model different tariff scenarios and evaluate their financial and operational effects. Scenario planning allows organizations to:

- For example, compare the impact of a 25% tariff increase on imported goods.

- Assess the viability of alternative sourcing options in different regions.

- Forecast changes in supplier lead times and fulfillment costs.

- Identify cost absorption thresholds before margins become unsustainable.

By adjusting factors like sourcing locations, inventory levels, and tariff thresholds, organizations can evaluate how each option affects key performance indicators (KPIs) including profitability, on-time delivery rates, supply chain management costs, and value at risk.

Comparing multiple scenarios allows you to determine which strategy best balances cost absorption and operational efficiency.

Demand and Price Elasticity Considerations

While mitigating supplier costs is one approach, companies can also explore demand-side strategies, such as adjusting pricing structures.

Rather than absorbing tariff-induced costs entirely, companies can pass some of these costs to customers. This requires a deep understanding of price elasticity — the relationship between price changes and demand fluctuations.

Leveraging machine learning and causal forecasting, businesses can analyze historical data to determine how price changes impact sales volumes. This analysis enables companies to identify optimal price points that balance revenue and customer retention, and test different demand-side strategies, such as promotions or volume-based pricing adjustments.

It’s key to compare scenarios where the company absorbs costs versus those where price increases are implemented. This approach drives informed decisions about whether to increase prices, maintain current pricing, or experiment with targeted discounts to offset tariff impacts.

Understanding Tariff Exposure, Costs, and Tolerances

With the threat of US tariffs ranging from 10% to 25% on various imports, businesses operating across multiple regions face escalating costs and trade barriers. As the world edges closer to a global trade war, concerns are growing among supply chain leaders. The tariff volatility and unpredictability threaten to increase costs for manufacturers, make US exports less competitive due to retaliatory tariffs, and potentially upend trade agreements.

With so much uncertainty, companies must prepare for multiple possible outcomes and develop contingency plans to mitigate the risks.

Preparing for the Future of Global Trade

The volatility of tariffs presents both risks and opportunities for supply chain leaders. As the global trade landscape continues to evolve, those who embrace advanced supply chain planning software and scenario planning will be best positioned to navigate challenges and disruptions.

The Atlas Planning Platform provides the advanced analytics and comprehensive modeling capabilities necessary to build resilience. Atlas’ scenario planning enables companies to model various tariffs and compare financial and operational impacts across different strategies. With built-in analytics, businesses can assess alternative sourcing options and tactically adjust supply chain strategies. Atlas’ AI and machine learning provides the ideal tools to determine price elasticity, allowing companies to experiment with different pricing strategies and be fully prepared for demand shifts.

Let us show you how the Atlas Planning Platform can help you turn uncertainty into an opportunity, mastering the ability to test multiple strategies, optimize costs, and maintain service levels to ensure competitiveness - even in the face of evolving tariff policies.