For decades, supply chain leaders have been under constant pressure to reduce costs and slash inventory – but it’s time to reframe the conversation from cuts and constraints to outcomes and opportunities.

That’s why we’re highlighting a concept the industry has been missing for far too long: Supply Chain Value Add – a fresh, holistic approach to understanding and enhancing the full impact of your supply chain decisions.

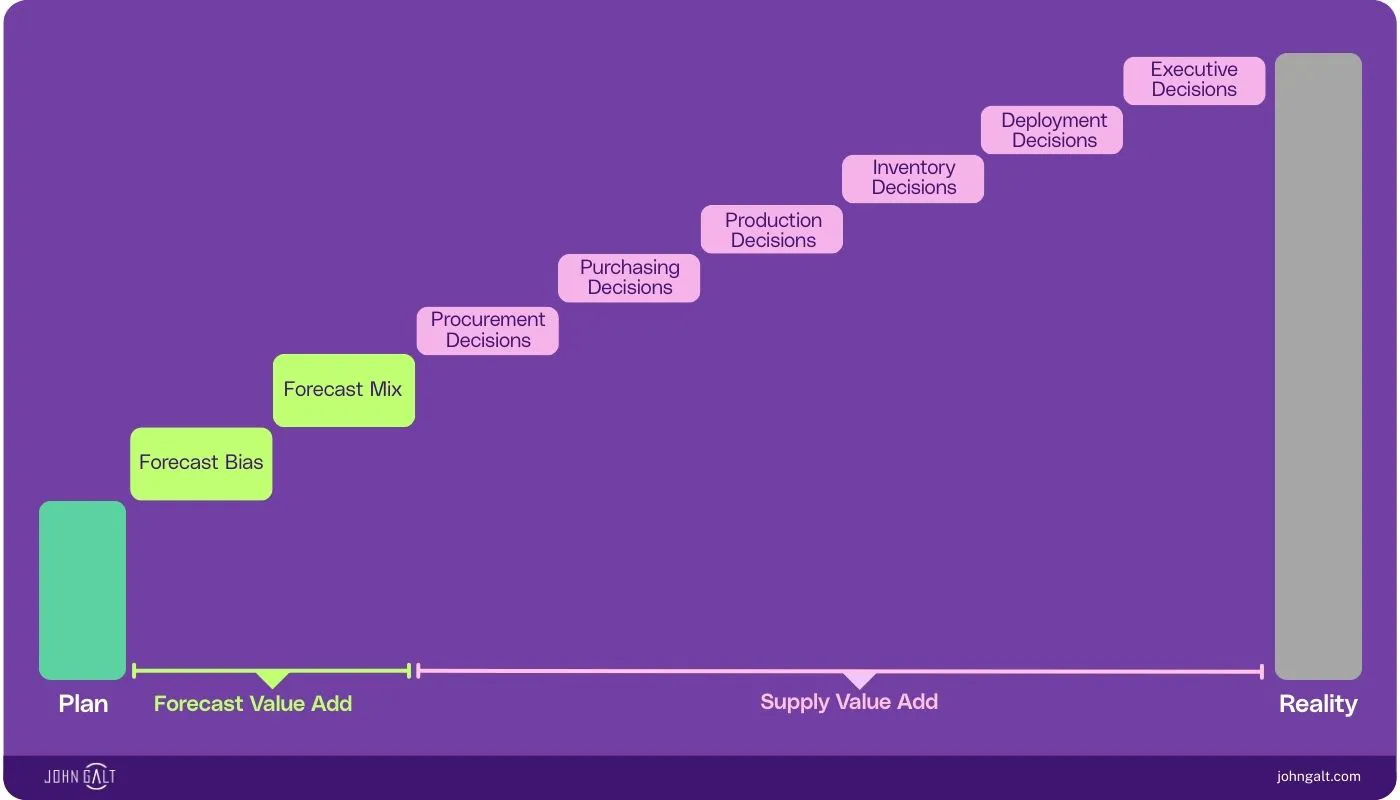

It is easy to blame forecast misses for inventory that goes above plan. However, mature organizations evaluate the different supply side decisions as well to understand root cause of excess inventory.

What Is Supply Chain Value Add?

Supply Chain Value Add is the incremental value created - or lost - at every stage of the supply chain decision-making process. It's not just about what you make; it’s about how you make it, move it, store it, and sell it. Each decision along this journey has the potential to increase efficiency and augment value, or unfortunately introduce unnecessary complexity and cost.

Supply Chain Value Add identifies gaps between your goals and reality, giving you insight into how to make the most of your inventory investments and make your plan a reality.

These are questions Supply Chain Value Add helps you answer:

Are we optimizing for the company as a whole, or just our individual functions?

Are we making decisions that add long-term value, or just short-term savings?

Are damaged, unsellable, excess, slow or obsolete inventories causing hidden issues?

Does vendor selection consider inventory impact on minimum order sizes?

Are we just moving inventory or are we addressing value to the organization?

Common Challenges

Let’s look at where this value often goes missing, and how to reclaim it.

1. Redundant Inventory Movements

Moving stock from one facility to another to resolve space constraints may seem like a fix, but it doesn’t necessarily create value. It adds transportation and handling costs to inventory that may sit idle for months or may have been better spent elsewhere.

2. Siloed Decision-Making

When different areas like production, procurement, and logistics each optimize for their own KPIs, the broader system suffers:

- Manufacturing overproduces to hit uptime goals.

- Procurement buys in bulk to reduce per-unit cost, resulting in overstock and straining already constrained warehouse space.

- Logistics ships half-full trucks to meet delivery windows, driving up costs.

Each group made a rational choice; but together, they created a dysfunctional outcome.

3. Looking Backwards

Are safety stock policies and segmentation rules focused only on past volatility? Are policies and strategies aligned to organizational initiatives or tied only to reducing inventory dollars? Focusing only on past demand variability calculations is standard and easy, but it doesn’t show the value of inventory investments in antifragility and current / future commercial strategies.

Your Gateway to Value

True end-to-end visibility is essential to measure and improve KPIs. Your supply chain planning software solution must do more than just automate tasks. It should empower improved supply chain decision-making across a variety of scenarios:

- Model cross-functional scenarios

- Set and monitor shared metrics

- Generate real-time alerts for misalignments or planning anomalies

Instead of only tracking inventory turns, imagine evaluating how a production schedule change affects working capital and service levels simultaneously.

That’s the kind of holistic thinking your supply chain needs to create business value.

According to Gartner: “Reduction targets for cost and inventory create apprehension and resistance among stakeholders, inhibiting the collaboration and innovation required to drive and sustain cost and performance improvement.” (Gartner, Shift Focus From Cost Reduction to Optimized Network Performance. Paul Lord.10 March 2025)

By often creating friction and resistance, these traditional reduction-based targets represent a barrier to real progress. The key is integrating decision-making and shared success metrics.

Let’s examine some opportunities to elevate value across some key planning functions:

- Procurement: Does vendor selection choose a larger minimum purchase for a lower price that results in excess inventory, negating any cost benefits? By making decisions holistically, teams consider the tradeoffs between holding costs, warehouse constraints, and purchase price.

- Purchasing: Are your MOQ strategies siloed by site, or considered globally? Harmonizing them can reduce redundancies and unlock purchasing leverage.

- Purchasing: One-time buys, discounted pricing tiers, and other purchasing deals may not be the bargain they appear to be.

- Production Planning: Are you consolidating raw material buying across SKUs and locations to get better terms and reduce waste? Are your batch sizes aligned with demand signals to prevent excess and obsolescence?

- Inventory Planning: Are your safety stock policies optimizing service levels without bloating working capital? Smart trade-off analysis ensures the balance between cost and service. While those goals may look good on paper, the real-world impact is often far less productive. What if these targets are actually holding back your supply chain’s ability to drive real business value?

- Deployment Planning: When faced with constrained space, a knee-jerk reaction may be to move stock between facilities to free up warehouse space. However, inventory moves like this cause redundant pick, pack and ship costs that may be better spent shaping demand on excess or aging inventory. This relieves warehouse space, brings in revenue, and reduces risks of inventory obsolescence and damage.

- Executive Decisions: Are your safety stock policies only focused on past volatility or fueling commercial strategies and directions? Are forecast and purchasing targets driven from a reasoned-plan, or from hope or budget goals that are not achievable? Forward-looking segmented planning and inventory strategies balance service and business drivers such as cash flow and growth.

Supply chains must strive to operate as cohesive networks instead of sets of isolated functions. Supply chain teams need robust capabilities to understand the downstream impact of each decision, measure net effects, and prioritize enterprise-wide wins over local optimizations.

With the right visibility and analytics in supply chain planning, companies can make more robust calculations and improve decisions based on outcomes. This allows teams to reallocate resources to higher-value activities, identify hidden cost centers and prevent inventory spikes before they happen – driving value across the end-to-end supply chain.

At the heart of Supply Chain Value Add is a simple but powerful question: “Is this decision truly adding value?”

Get Quick, Tangible Value with the Atlas Planning Platform

At John Galt Solutions, we help companies unlock their Supply Chain Value Add by getting them to value faster.

The AI-powered Atlas Planning Platform gives you the ability to make smarter, more confident supply chain decisions across every step, from demand planning and inventory optimization to production scheduling, collaborative S&OP and beyond.

Atlas turns your supply chain into a source of measurable value, connecting your teams and aligning your metrics to strategies to deliver insights that actually move the needle - fast.

You deserve a system that works the way it should: delivering results quickly, improving KPIs like inventory turns and service levels, and giving you the confidence to make the right calls. Let’s talk!